Regional Housing Market shows slight decline through building permits; demand for multi-family units declines

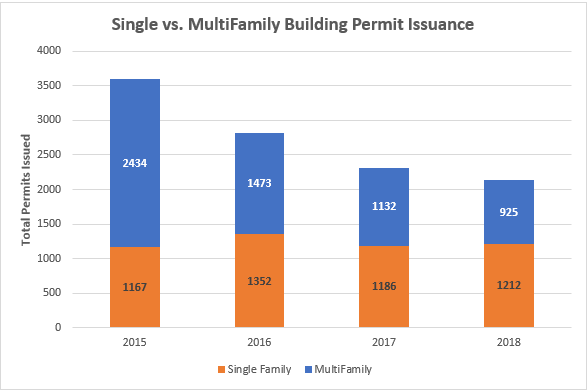

Utilizing 2018 Census Building Permits data, CDRPC notes a continued slight decline in housing starts for the Capital Region. Utilizing last year’s analysis and the current 2018 data, we can see a slight decline in overall building permit issuance and a decline in the share of multi-family permits issued. In the short term, overall permit issuance and the share of multi-family permits have continued a decline since a 15 year high in 2015. Permit issuance has decreased by 40.7% since 2015 with multi-family permits declining 62% overall. In the long term, permit issuance is still in line with the overall trend since 2012 and is relatively stable at that time. Since 2012, permit issuance saw a 2.6% change overall, with a 7.8% increase in single-family permits causing a slight overall increase. Permit issuance is still below the levels seen in the early 2000s but above the early 2010 years.

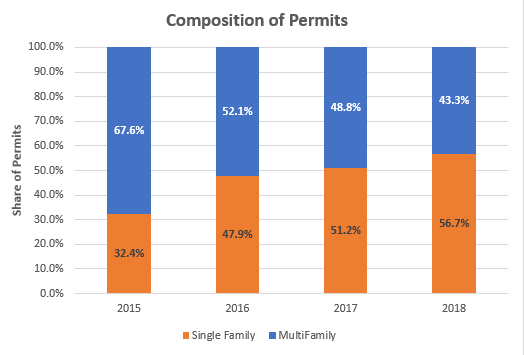

Building permit issuance regained momentum in 2012 following the recession the country faced in 2008-2011. Multi-family units were a big part of this renewed growth with 7,924 permits being issued throughout the region between 2012 and 2017. With 15,109 total permits being issued in this time, multi-family permits were issued at a rate of 52%. In 2018 however, multi-family permits were issued at a rate of just 43.3%

Total Building Permits

2,137 total building permits were issued in 2018, 181 fewer permits than 2,318 in 2017. While building permit issuance in the region was annually above 3,000 in the early 2000’s it has exceeded that figure only once since 2006. An outlier year in 2015 saw 3,601 building permits issued throughout the region. However, since 2012, the trend of permits has hovered around 2,000 each year and this year’s total continues that trend.

Shares of Building Permits

A higher volume of multi-family permits being issued has been noted as a trend for some time. Single-family permits dominated the market between 2002 and 2010, however, this began to shift in 2011 when multi-family permits made up most permits for the first time in 15 years throughout the region. Multi-family permits hit a high of 67.6% of total permits issued in 2015, but have been declining ever since. In 2018, multi-family permits made up 43.3% of total permits issued, a drop from 2017’s 48.8%.

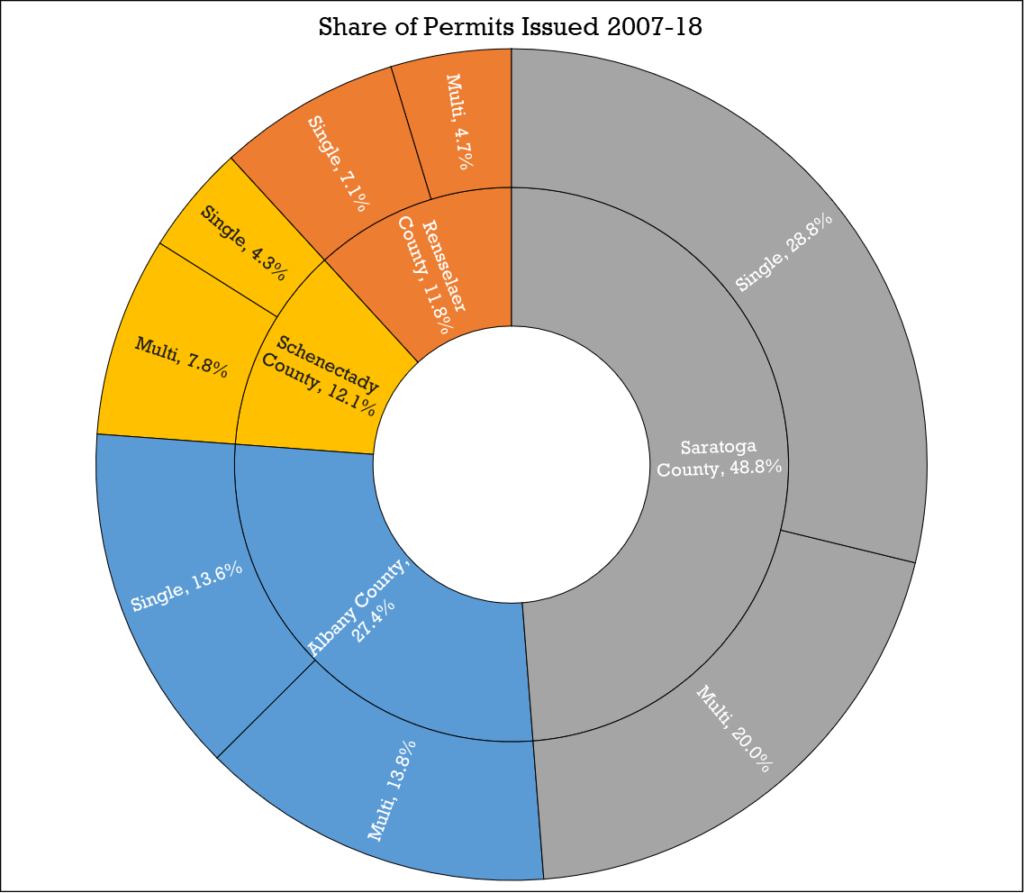

Broken down by county, Saratoga County gave out the largest share of permits since 2007 with 48.8% of the region’s permit issuance. Single-family permit made up the largest share of Saratoga’s permits at 28.8%. Albany County saw the second highest share of permits issued at 27.4% and saw an almost even distribution of singly and multi-family permits, with 13.8% of permits being multi-family and 13.6% being single-family. Schenectady and Rensselaer Counties issued a similar share of permits at 12.1% and 11.8% respectively.

Permits by Municipality

While we know the total number of permits issues throughout the region, the pace of development varies greatly throughout the region. From 2008 through 2018, Colonie issued by far the most permits, with 4,070 total permits issued, followed by Halfmoon (2,257), Saratoga Springs (1,522), Albany (1,204), and Bethlehem (1,202). For Colonie, Halfmoon, and Bethlehem, half or most of these permits were for single-family residential units with 2,436 in Colonie, 1,446 in Halfmoon, and 604 in Bethlehem. Saratoga Springs and Albany saw a much higher rate of multi-family permits issued with 1,045 in Saratoga Springs and 933 in Albany over ten years. These are the only communities that issued over 1,000 permits over the ten-year period, however many communities issued between 800 and 1,000 permits as well over this ten-year period. Check out the map below for a comprehensive look at permit issuance in Capital Region communities.

In 2018, Colonie (380), Saratoga Springs (242) and Halfmoon (161) again saw the most permits issued, with Stillwater (146) and Guilderland (140) close behind. Of these communities, Colonie and Halfmoon saw the largest share of single-family permits with 218 in Colonie and 159 in Halfmoon. Larger shares of multi-family permits were seen in Saratoga Springs (162), Guilderland (108), and Stillwater (96). Ballston, Rotterdam, and Albany also issued over 100 total permits in 2018. For a detailed breakdown of each community’s permit issuance between 2008 and 2018, check out the table below.

Existing Housing Trends Throughout the Region

In both the Capital Region and across the country, both sales and inventory of existing homes are down. According to reports in 2018 and 2019 from the Greater Capital Association of Realtors, In 2018 the Capital Region saw fewer existing homes being sold coupled with increased sales prices and declines in sales of homes. Due to the lack of available homes, prices of each available home increased with fewer homes were sold, making it more difficult for first-time homeowners to purchase a new home. Along with a lower supply, increased sale prices can also be associated with a higher demand to purchase homes in the region.

This trend continued through January 2019, with sales decreasing to 757 sales, or 5%, from February 2018’s 855 sales. While it is still considered to be low, the inventory of houses has seen growth since February 2018 through January 2019, with 4,372 total units in the Capital Region in January 2019 compared to February 2018’s 4,177 units for sale.

These factors create barriers for people who want to purchase homes and helps to build up demand for new residential construction. Lower inventories and high demand for homes in the Capital Region could help generate higher building permit issuance then we have seen over the past two years.