Capital Region Foreign-Trade Zone #121

Foreign-Trade Zone Benefits | Using Foreign-Trade Zones | FTZ Sites

What is a Foreign-Trade Zone?

What is a Foreign-Trade Zone?

A Foreign-Trade Zone is a secured, designated location in the United States, in or near a U.S. Customs Port of Entry, where foreign and domestic merchandise is generally considered to be in international commerce (i.e., outside of the U.S. Customs territory).

The purpose of Foreign-Trade Zones is to stimulate international trade and create jobs and investment in the United States rather than abroad. Foreign merchandise may enter a Foreign-Trade Zone without a formal Customs entry or the payment of Customs duties or government excise taxes. If the final product is exported, no U.S. Customs duties or excise taxes are levied. If the final product is imported into the United States, Customs duties and excise taxes are due only at the time of transfer from the FTZ. If authorization has been granted, the duties paid are the lower of those applicable to the final product itself or its component parts (inverted tariff option).

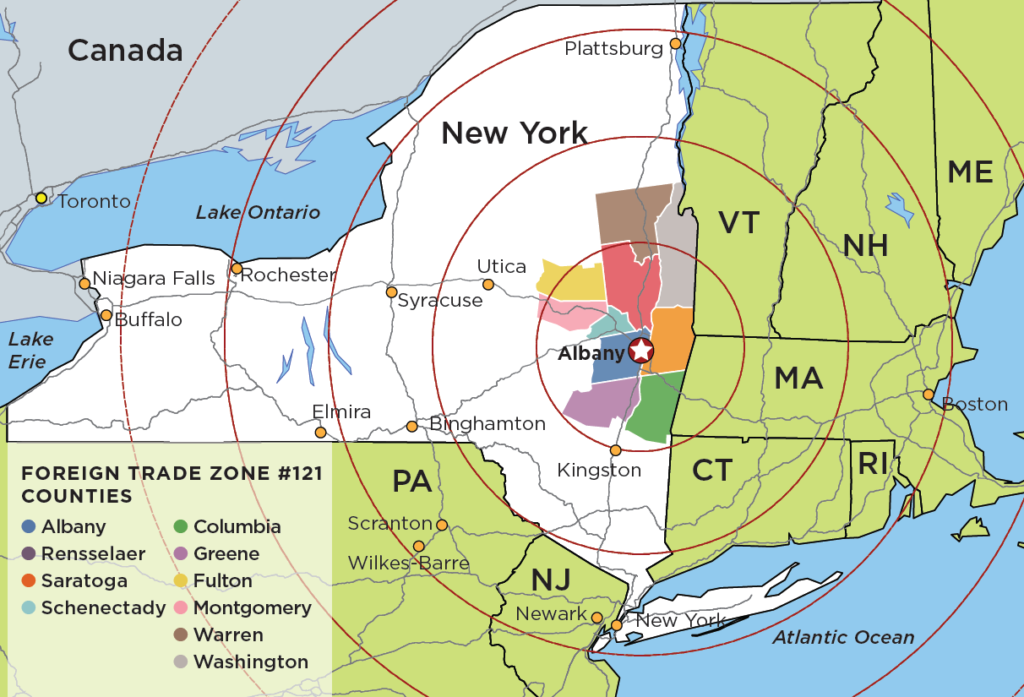

In 1985, CDRPC was granted the authority to establish a Foreign-Trade Zone (FTZ #121) covering Albany, Rensselaer, Saratoga and Schenectady counties by the Foreign-Trade Zones Board of the U.S. Department of Commerce (Board Order No. 307, 07/18/85). Authority was expanded to cover Fulton County in 1996 (Board Order No. 922, 09/25/97). In mid- 2010, the Foreign-Trade Zones Board approved the reorganization and expansion of FTZ #121 under the new Alternative Site Framework (ASF) (Board Order No. 1694, 07/08/10). FTZ #121 now serves 10 counties: Albany, Columbia, Greene, Fulton, Montgomery, Rensselaer, Saratoga, Schenectady, Warren and Washington.

2010, the Foreign-Trade Zones Board approved the reorganization and expansion of FTZ #121 under the new Alternative Site Framework (ASF) (Board Order No. 1694, 07/08/10). FTZ #121 now serves 10 counties: Albany, Columbia, Greene, Fulton, Montgomery, Rensselaer, Saratoga, Schenectady, Warren and Washington.

A site which has been granted zone status may not be used for zone activity until the site has been separately approved for FTZ activation by local U.S. Customs and Border Protection officials. Once approved, zone activities remain under the supervision of Customs and are subject to spot checks and periodic inspections at any time. Although FTZs are considered in international commerce, FTZ sites and facilities remain within the jurisdiction of local, state and/or federal governments and agencies.

Foreign Trade Zone (FTZ)-121: Capital Region Opportunities Webinar

CDRPC, the Center for Economic Growth, and the Port of Albany hosted a joint webinar detailing the benefits of Capital Region’s FTZ 121 for importers and operations. National FTZ experts, Melissa Irmen and Sean Lydon at ISCM, reviewed exciting facts and popular myths about the program and provided insight into how the program might apply to Capital Region operations. ISCM is a Washington, DC based consulting firm with unmatched experience in Foreign-Trade Zone (FTZ) applications, setup, technology, and regulatory agency insight.

Watch the Recording of the Webinar Here