Producer and Consumer Price Index

The Capital District Regional Planning Commission (CDRPC) has updated the Producer Price Index (PPI) and Consumer Price Index (CPI) with the most current and available data. Both PPI and CPI provide key insights into the economy. From January 2024 to May 2024, PPI has increased slightly from the latter part of 2023. CPI’s aggregate index has also shown a slow increase, with an average value of 311.7.

Producer Price Index

The Producer Price Index (PPI) had been increasing since April 2020 and peaked at 280.25 in June 2022. Since then, values steadily decreased until July 2023. Between July 2023 and September 2023, PPI increased from 253.84 to 258.93 (+2.0%). After September 2023, PPI began decreasing again, reaching the 2023 yearly low of 249.87 in December 2023. In 2024, PPI values have slowly increased from the end of 2023. From January 2024 to May 2024, PPI increased from 251.31 to 254.97 (+1.46%). However, from April 2024 to May 2024, PPI decreased by 0.85%.

Consumer Price Index

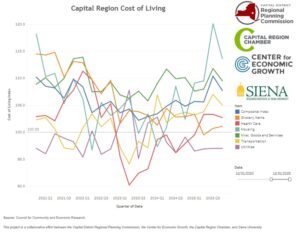

Consumer Price Index (CPI) measures the average change in price over time of a market basket of consumer goods and services. These categories include:

- Apparel and Upkeep

- Education and Communication

- Food and Beverages

- Housing

- Medical Care

- Recreation

- Transportation

- Other Goods and Services

- All Items (Composite Index)

CPI is the most significant indicator of inflation because it measures how much the prices of everyday goods and services fluctuate over time. In the first half of 2024, recreation, housing, food and beverages, apparel and upkeep, and education and communication have increased at a slow rate. In contrast, transportation, the composite (all items), medical care, and other goods and services have increased at a more noticeable rate. The all items category has increased from 281.1 to 310.3 from January 2022 to January 2024, reflecting an approximate increase of 10.39%. This significant rise indicates a noticeable increase in the cost of living over the two-year period. Such an increase suggests that consumers are paying more for a wide range of goods and services, which can impact household budgets and spending habits.