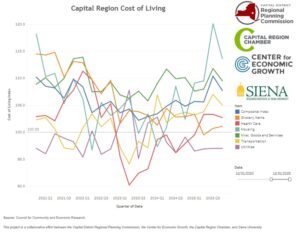

CPI Year-to-Year Change Hovers Above 0%

The Capital District Regional Planning Commission has compiled the annual Consumer Price Index (CPI) average for 2015. This marks the third year in a row that the CPI has increased at a rate of less than 2% from calendar year to calendar year.

CPI Increases by 0.1185% from 2014

Information shows that the Consumer Price Index increased by 0.1185% from 2014. The CPI is important to communities in New York State because it is linked to the Real Property Tax Cap. Beginning in 2012, local governments in New York State were subject to annual tax levy increases limited to the established real property tax cap. Communities are subject to a cap of either 2% or the increase in CPI year-to-year, whichever is less. This change in CPI between 2014 and 2015 impacts communities with Fiscal Years beginning on July 1.

About the Real Property Tax Cap

On June 24, 2011, Governor Andrew Cuomo signed the Real Property Tax Cap into law, Chapter 97 of the NYS Laws of 2011. Commonly called the Tax Cap, it is limited to either an increase of 2% or the percentage increase in the Consumer Price Index year-to-year, with limited adjustments or exceptions.

The table below shows the CPI period that is applicable to communities based on the start of their Fiscal Year.

| Fiscal Year Beginning | CPI Period |

| January 1 | July-June |

| April 1 | October-September |

| June 1 | December-November |

| July 1 | January-December |

About the Consumer Price Index

The Consumer Price Index is a measure of the average change over time in the prices paid. The CPI considers prices paid by urban consumers for a pre-determined selection of consumer goods and services. It is published monthly by the US Department of Labor, Bureau of Labor Statistics. The Capital District Regional Planning Commission shares this information monthly on its website and publishes the same information in its bi-monthly newsletter, Capital District Data.

For More Information

For historical trends in the Consumer Price Index, see CDRPC’s Consumer and Producer Price Index page. For more information on the Tax Cap and its calculations, see the Office of the State Comptroller’s site.