Capital District School District Finances

School districts are required to submit annual financial reports for review by the New York State Comptroller’s office, which is also charged with the responsibility for designing the report forms and the uniform system of accounts upon which they are based. Periodic examinations of the accounts of school districts are conducted by municipal examiners, who not only check internal controls, State compliance, and financial reporting, but also assist district officials in instituting improved financial management procedures.

Data extracted from budgets, annual financial reports, and other documents which school districts file are published in the Special Report on Municipal Affairs which the Comptroller must submit to the Legislature annually. The annual financial data, as well as information from other sources, have undergone rigorous desk review, statistical comparisons, and computer edit checks to assure validity prior to publication. Financial data of trust funds (TA, TE, TN) are not included in the Report. In order to provide comparable data for all school districts and to reduce instances of double counting, interfund revenues and transfers between funds are also not included in the financial data. In spite of this procedure, some double counting of financial data may occur due to interfund transactions. The data are presented as a statistical overview and is not intended to provide detailed accounting or legal information concerning the finances or financial condition of a school district. For example, the fact that certain school districts have revenues less than expenditures does not necessarily mean a school district has an operating deficit. Other financing sources such as borrowings or the appropriation of fund balance are not classified as revenues and could account for the apparent shortfall. Detailed financial information is available for any individual school District by contacting the New York State Comptroller’s Office.

CDRPC has taken selected data on revenues and expenditures for the Region’s school districts from the Comptroller’s Special Report and summarized it in the following tables.

Mergers

For FY 2009, the Maplewood-Colonie Common School District was merged into the North Colonie Central School District.

General Definitions

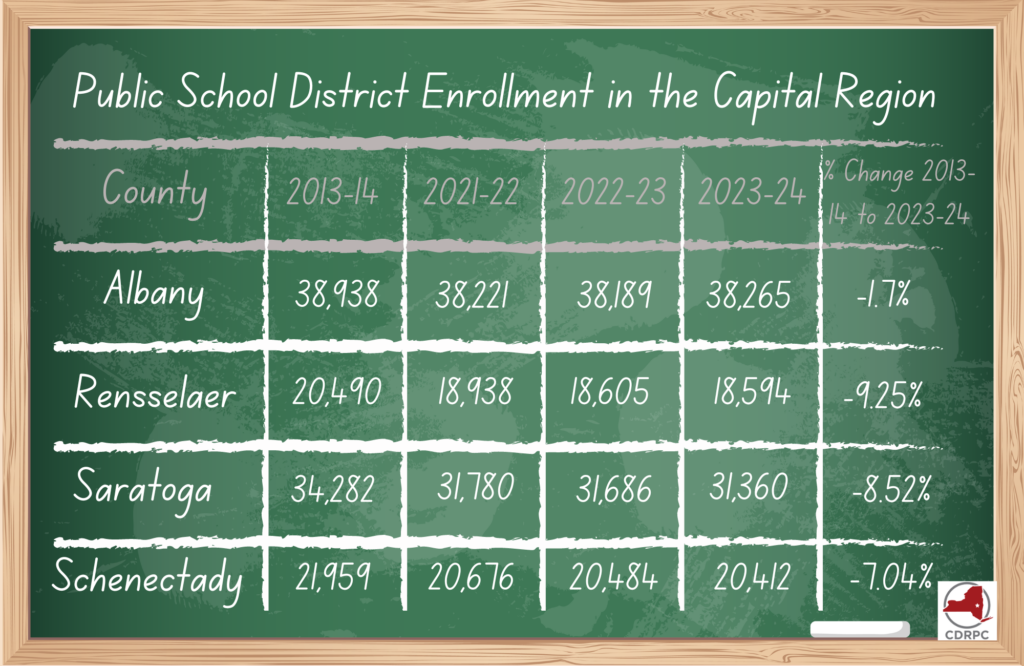

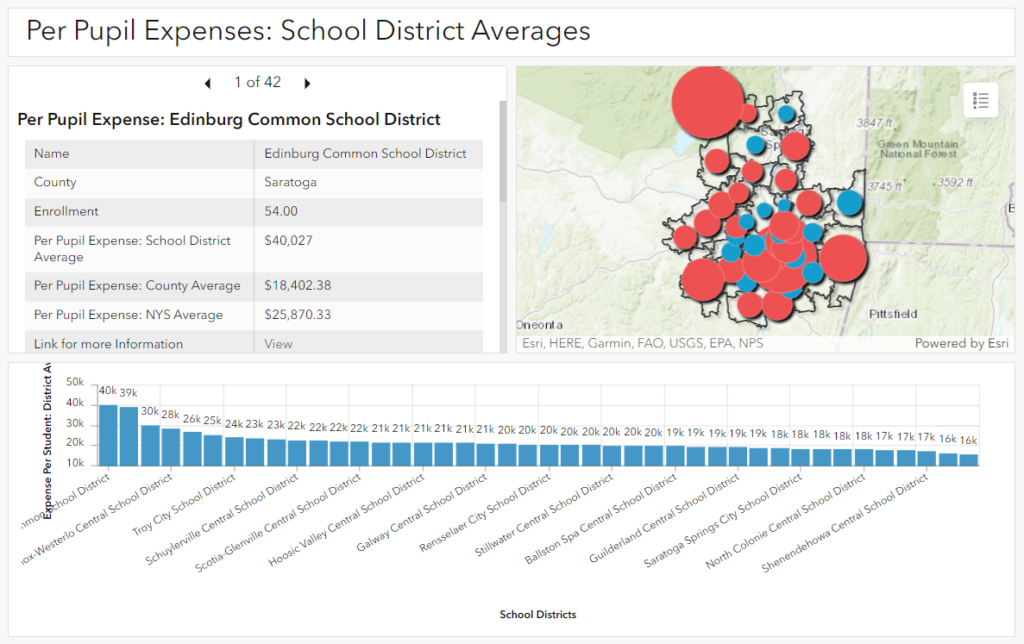

Enrolled Pupils: The number of pupils enrolled in the school district as shown in the New York State Education Department publication, Public School Enrollment and Staff. School districts which do not show a figure do not maintain a school but contract with other school districts for the instruction of their children. The enrollment numbers may not include students whose education costs are financed in whole or in part by the district, but receive instruction and services from another public or private school.

Market Value of Taxable Property per Pupil: The actual valuation of taxable real property on the tax rolls determined by applying the final regular equalization rate established by the State Board of Real Property Services for the rolls used to levy taxes for school purposes, divided by the number of pupils enrolled in the school district.

Total Debt Outstanding: All indebtedness for school district purposes outstanding as of the end of the fiscal year.

Revenue Definitions

Tax Revenue: Real Property Taxes. This represents the total amount of real property taxes received by the school district. The levy imposed by a school district in any one year may provide funds for both the year of the levy and the succeeding year by means of the inclusion of a planned balance. This procedure is permitted for all major school districts, except city school districts, in order to avoid shortages of cash between the opening of the school fiscal year and the actual receipt of property taxes. Taxes levied for a public library sponsored by a school district and taxes levied for a central high school district by a component elementary district are included, as well as Federal payments and contributions in lieu of taxes and interest and penalties on real property taxes.

Non-Property Taxes: These amounts consist of receipts by school districts from local sales and compensating use taxes and local consumer utility taxes. These taxes are locally imposed but collected and administered by the State. After deducting collection costs from the gross collection of these local sales taxes, the State remits the net collections to the localities. Non-property taxes and their use by school districts are as follows. Retail Sales and Compensating Use Tax. These taxes may be imposed only by counties and cities, which retain the proceeds for municipal purposes or distribute all or part of the proceeds to the school districts. Since receipts from the retail sales and compensating use tax are distributed to school districts on the basis of the average daily attendance or enrollment of the public school pupils who are residents of the county levying the tax, school districts in adjoining counties which have territory in these counties may share in the distribution of the receipts from this tax. Consumer Utility Tax. This tax can be imposed only by counties, cities, and school districts with territory in cities under 125,000 population. The following school districts in cities imposed the tax, all at the maximum rate of 3%: Albany, Cohoes, Watervliet, and Schenectady.

Federal & State Aid: State Aid. Receipts from all types of State aid available to public schools are included here. Amounts of State aid deducted for each district’s assessment for retirement and for the percentage of teachers’ salaries for transmittal to the New York State Teacher’s Retirement System are included as revenues to the district.

Federal Aid: This includes receipts from all types of Federal aid available to public schools.

Other Revenue: This represents receipts not otherwise classified, including tuition and transportation of non-resident pupils, proceeds of insurance adjustments, sales of surplus property, lunch and store fund sales, and interest on investments. Interfund revenues are not included under this category.

Expenditure Definitions

Services Expense: This category represents total expenditures for operating costs. Included in Current Operations are personal services, employee benefits, and contractual expenditures. Personal Services represent total expenditures for salaries and wages. Employee Benefits represent the district’s share of State and teacher’s retirement, social security, workers’ compensation, unemployment, disability, medical, dental and various other types of insurance. Contractual Expenditures represent all operating costs exclusive of personal services and employee benefits, and may include costs of students who reside within the district but receive instruction and services from another public or private school. Services by BOCES includes all payments made by the Boards of Cooperative Educational Services.

Equipment & Capital Outlay: This represents expenditures incurred for initial purchase or replacement of furniture and equipment (including buses) and for other capital outlays such as construction, purchase of rights of way, land and existing structures.

Debt Service Expense: This consists of principal and interest payments for the redemption of bonds and notes. Due to accounting treatments, these amounts may not include principal payments on short term indebtedness and bond anticipation notes, and bond anticipation notes redeemed from the proceeds of bond issues.